Running a successful business requires careful financial management and planning. To effectively monitor the financial health of your company, it’s crucial to maintain and utilize key financial documents. These documents provide vital insights into your business’s performance, profitability, and future prospects. In this article, we will explore the essential financial documents that every business owner should have and understand.

Income Statement

The income statement, also known as the profit and loss statement, summarizes the revenue, expenses, and net income or loss of your business over a specific period. It provides a snapshot of your company’s profitability and helps you track whether your business is generating a profit or experiencing losses. By regularly reviewing your income statement and using effective services like PayStubCreator to ease filling and submitting your financial documents, you can identify areas of concern and make informed decisions to improve your financial performance.

Balance Sheet

The balance sheet provides a snapshot of your business’s financial position at a specific point in time. It presents the company’s assets, liabilities, and shareholders’ equity. The balance sheet helps you assess the financial strength and stability of your business, measure its liquidity, and evaluate its ability to meet short-term and long-term obligations. By comparing balance sheets from different periods, you can analyze trends and identify potential financial risks.

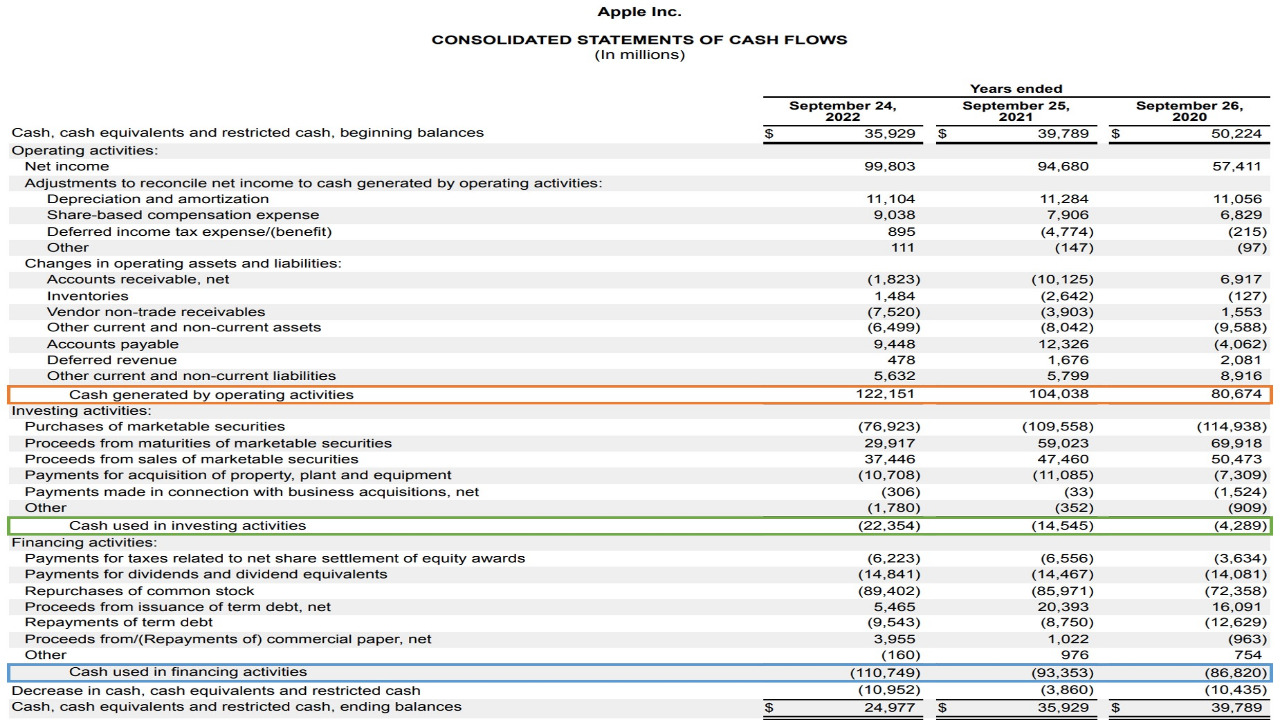

Cash Flow Statement

The cash flow statement tracks the inflows and outflows of cash within your business during a given period. It provides an overview of your business’s cash position and helps you understand how cash is being generated and used. By monitoring your cash flow, you can ensure that your business has enough liquidity to meet its financial obligations, plan for future investments, and identify potential cash flow issues before they become problematic.

Budget

A budget is a financial plan that outlines your projected revenue and expenses over a specific period. It serves as a roadmap for your business’s financial activities and helps you allocate resources effectively. By comparing your actual financial results to the budgeted amounts, you can identify any deviations and take corrective actions. A budget also enables you to set financial goals, track your progress, and make informed decisions about resource allocation and cost control.

Financial Projections

Financial projections are estimates of your business’s future financial performance based on historical data and assumptions. These projections help you assess the viability of new business ventures, plan for expansion or acquisition, secure financing, and make strategic decisions. They typically include projected income statements, balance sheets, and cash flow statements, allowing you to anticipate potential financial challenges and opportunities.

Tax Returns and Filings

Business owners must comply with various tax obligations, and maintaining accurate and up-to-date tax records is essential. Tax returns and filings document your business’s taxable income, deductions, and tax liabilities. By keeping these documents organized and readily accessible, you can ensure compliance with tax laws, minimize the risk of audits or penalties, and effectively manage your tax planning and strategy.

In conclusion, managing the financial aspects of your business requires the use of key financial documents. These documents, such as income statements, balance sheets, cash flow statements, budgets, financial projections, and tax returns, provide crucial information for monitoring your business’s performance, making informed decisions, and ensuring regulatory compliance. By maintaining accurate and up-to-date financial records, you can gain valuable insights into your business’s financial health and take proactive steps to achieve long-term success.

Leave a Reply